Get more information about:

The Gross Domestic Product Annualized released by the US Bureau of Economic Analysis shows the monetary value of all the goods, services and structures produced within a country in a given period of time. GDP Annualized is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. Generally speaking, a high reading or a better than expected number is seen as positive for the USD, while a low reading is negative.

| |||||||||||

Option price, Volatility and liquidity in the options market place... is all it matters.

Tuesday, August 29, 2017

Gross Domestic Product Annualized (Q2) - Aug 30th

Monday, August 14, 2017

Thursday, August 3, 2017

Monday, July 24, 2017

GOOG, AMZN, FB Earnings this week

More than a third of the S&P 500 companies and 13 Dow stocks reporting this week.

Monday

Earnings: Alphabet, Anadarko Petroleum, Celanese, Halliburton, Illinois Tool Works, Luxottica, Stanley Black and Decker, Ryanair, Arconic, Manpower Group, VF Corp

Tuesday

FOMC meeting begins

Earnings: 3M, Caterpillar, McDonald's, United Technologies, General Motors, Eli Lilly, Biogen, Amgen, AT&T, Chipotle, U.S. Steel, Express Scripts, Kimberly-Clark, Freeport-McMoran, Seagate Technology, JetBlue, TransUnion, T. Rowe Price, Akamai, Texas Instruments

Wednesday

Earnings: Facebook, Boeing, Coca-Cola, Gilead Sciences, PayPal, Samsung, Discover Financial, Northrop Grumman, Nasdaq OMX, Hershey, Corning, DR Horton, Daimler, Ford, LVMH, Anthem, General Dynamics, Norfolk Southern, State Street, Six Flags, F5Networks, Vertex Pharma, Whole Foods

Fed Meeting

Thursday

Earnings: Amazon, Intel, Starbucks, MasterCard, Bristol-Myers Squibb, Celgene, Fiat Chrysler, Verizon, Comcast, Twitter, Altria, A-B InBev, AstraZeneca, Royal Dutch Shell, UPS, Total, Raytheon, Dr. Pepper Snapple, Southwest Air, Dunkin Brands, Deutsche Bank, Diageo, Nokia, Mattel, Boston Beer, Expedia, Brunswick, Baidu

Friday

Earnings: Exxon Mobil, Chevron, Merck, American Airlines, AbbVie, Barclays, UBS, Baker Hughes, BT Group, Cabot Oil and Gas, BNP Paribas, TransCanada, Credit Suisse, Weyerhaeuser, Nomura, CMS Energy

Wednesday, July 19, 2017

Tuesday, July 18, 2017

NDX ATH's again ??

The up-move that started in NDX on 7/7 has been strong, taking us back to the ATH's today. Although the uptrend is very strong the market could very well go sideways from here for a few weeks before determining the next direction.

The 30min time frame the index has moved up considerably since its breakout on 7/7.

The daily time-frame shows the index's almost parabolic move and seems a bit over stretched above the 50 DMA.

The 30min time frame the index has moved up considerably since its breakout on 7/7.

The daily time-frame shows the index's almost parabolic move and seems a bit over stretched above the 50 DMA.

Friday, July 7, 2017

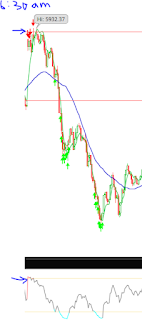

NDX 30m vs Daily chart

30 Min: chart shows a range bound movement between 5670 and 5570. Today we closed at the top of that range. Monday will be interesting to see weather we breakout of that range or move down to the bottom of the range.

Daily: Today's big green bar above the 50 DMA is bullish and could be signaling a reversal of the down trend in NDX.

Subscribe to:

Posts (Atom)