Option price, Volatility and liquidity in the options market place... is all it matters.

Wednesday, December 27, 2017

Thursday, October 5, 2017

Tuesday, October 3, 2017

FRIDAY, OCT 06 - Economic data

12:30 USD Nonfarm Payrolls (Sep)

generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish),

12:30 USD Unemployment Rate (Sep):

a decrease of the figure is seen as positive (or bullish) for the USD, while an increase is seen as negative (or bearish),

Tuesday, August 29, 2017

Gross Domestic Product Annualized (Q2) - Aug 30th

Get more information about:

The Gross Domestic Product Annualized released by the US Bureau of Economic Analysis shows the monetary value of all the goods, services and structures produced within a country in a given period of time. GDP Annualized is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. Generally speaking, a high reading or a better than expected number is seen as positive for the USD, while a low reading is negative.

| |||||||||||

Monday, August 14, 2017

Thursday, August 3, 2017

Monday, July 24, 2017

GOOG, AMZN, FB Earnings this week

More than a third of the S&P 500 companies and 13 Dow stocks reporting this week.

Monday

Earnings: Alphabet, Anadarko Petroleum, Celanese, Halliburton, Illinois Tool Works, Luxottica, Stanley Black and Decker, Ryanair, Arconic, Manpower Group, VF Corp

Tuesday

FOMC meeting begins

Earnings: 3M, Caterpillar, McDonald's, United Technologies, General Motors, Eli Lilly, Biogen, Amgen, AT&T, Chipotle, U.S. Steel, Express Scripts, Kimberly-Clark, Freeport-McMoran, Seagate Technology, JetBlue, TransUnion, T. Rowe Price, Akamai, Texas Instruments

Wednesday

Earnings: Facebook, Boeing, Coca-Cola, Gilead Sciences, PayPal, Samsung, Discover Financial, Northrop Grumman, Nasdaq OMX, Hershey, Corning, DR Horton, Daimler, Ford, LVMH, Anthem, General Dynamics, Norfolk Southern, State Street, Six Flags, F5Networks, Vertex Pharma, Whole Foods

Fed Meeting

Thursday

Earnings: Amazon, Intel, Starbucks, MasterCard, Bristol-Myers Squibb, Celgene, Fiat Chrysler, Verizon, Comcast, Twitter, Altria, A-B InBev, AstraZeneca, Royal Dutch Shell, UPS, Total, Raytheon, Dr. Pepper Snapple, Southwest Air, Dunkin Brands, Deutsche Bank, Diageo, Nokia, Mattel, Boston Beer, Expedia, Brunswick, Baidu

Friday

Earnings: Exxon Mobil, Chevron, Merck, American Airlines, AbbVie, Barclays, UBS, Baker Hughes, BT Group, Cabot Oil and Gas, BNP Paribas, TransCanada, Credit Suisse, Weyerhaeuser, Nomura, CMS Energy

Wednesday, July 19, 2017

Tuesday, July 18, 2017

NDX ATH's again ??

The up-move that started in NDX on 7/7 has been strong, taking us back to the ATH's today. Although the uptrend is very strong the market could very well go sideways from here for a few weeks before determining the next direction.

The 30min time frame the index has moved up considerably since its breakout on 7/7.

The daily time-frame shows the index's almost parabolic move and seems a bit over stretched above the 50 DMA.

The 30min time frame the index has moved up considerably since its breakout on 7/7.

The daily time-frame shows the index's almost parabolic move and seems a bit over stretched above the 50 DMA.

Friday, July 7, 2017

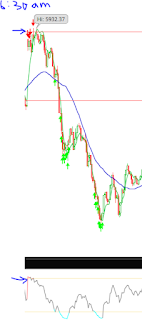

NDX 30m vs Daily chart

30 Min: chart shows a range bound movement between 5670 and 5570. Today we closed at the top of that range. Monday will be interesting to see weather we breakout of that range or move down to the bottom of the range.

Daily: Today's big green bar above the 50 DMA is bullish and could be signaling a reversal of the down trend in NDX.

Wednesday, July 5, 2017

Wednesday, May 17, 2017

NDX down $143 BTFD?

NDX fell $143, almost a replay of 3/21 which put us in a box for a month until 4/21. The market gaped up out of that box on 4/22. What happened today could do the same? We trade in a box for a month and breakout after a month or stay in it for the rest of the summer? Is it time to buy the dip? I would not be surprised to see that happen tomorrow as we have seen it happen so often. I was thinking of the consequences of the dip buyers today if you thought it was just another day where the market reverses mid day and closes near the highs of the day. It was definitely a trending day with one straight line downwards VIX was up +4.9 USD was down -5.8 the markets reaction is unknown to me either political of banks related? who knows. I believe it was just another correction that happens after a steep market moves.

Thursday, April 27, 2017

GDP Price Index released Friday AM

| 12:30 USD Gross Domestic Product Price Index (Q1) PRELIMINAR 2.0% 2.1% |

| 12:30 USD Gross Domestic Product Annualized (Q1) PRELIMINAR 1.3% 2.1% |

Changes in the GDP price index are followed as an indicator of inflationary pressure that may anticipate interest rates to rise.

Generally speaking, a high reading is seen as positive, or bullish for the USD, while a low reading is seen as negative, or bearish.

Monday, April 24, 2017

NDX breakout

NDX gaped up today, out of a consolidation zone, it has been building since the end of Feb 17. This huge gap up is an interesting move and will have to see if it gets filled in the next few day or the markets continue to keep its uptrend, that started since the election on Nov 8th. Another interesting observation is that NDX is at new all time high but the SPY and DJI are not. The catalyst for the move seems to be the French election results that came out today as economist were probably closely watching European politics after the BRIXIT's unexpected results.

Some important earning coming out this Thurs Apr 27 include GOOG, INTC.

Some important earning coming out this Thurs Apr 27 include GOOG, INTC.

Tuesday, March 21, 2017

An end to the relentless bull?

Today NDX slide $80 the overall move was more then $100 since the market opened up $25 in the morning, moved up a little more and then turned around and printed one the longest candles that I have not seen in a long time. The next logical stop is the 50DMA just below todays price at $5300 if the market continues its slide tomorrow we will certainly see some activity near that price level.

I think most people trading this recent uptrend may have not seen a down move of this scale and how rapid price action was today. I can imagine some traders giving up all the year worth of profits with a move like this and may be reconsidering carrier options tonight. One thing I am sure of is that this kind of move brings volatility and the daily rage expands for some time preceding the move. In my opinion tomorrow could be another down day as days like this signals a trend reversal or it could another dip that gets bought up in a hurry by hungry bulls just like we have seen with this uptrend.

I think most people trading this recent uptrend may have not seen a down move of this scale and how rapid price action was today. I can imagine some traders giving up all the year worth of profits with a move like this and may be reconsidering carrier options tonight. One thing I am sure of is that this kind of move brings volatility and the daily rage expands for some time preceding the move. In my opinion tomorrow could be another down day as days like this signals a trend reversal or it could another dip that gets bought up in a hurry by hungry bulls just like we have seen with this uptrend.

Monday, March 6, 2017

Fed rate hike expected in March

Expectation for a March rate hike have been raised to 81%. The Federal Open Market Committee meeting is scheduled for March 14-15.

Friday, February 24, 2017

NDX closes up once again!!

Since breaking out (of the grey-box) in the beginning of the new year, NDX has been in an uptrend like never before??

Despite the predictions (of financial guru's) of a slower economy and a down trend, in the equity markets, commensurate with the change in the US Govt, the Fed signaling hikes in interest rates this year, the market is unaffected. It seems to be welcoming the announcements of de-regulations and the enactment of restrictions on foreign trade. One of the reasons for this bull run could be the better than expected earnings this quarter being reported by the US companies, as well as, the prevailing economic conditions such as record low unemployment and interest rates.

Today, I read somewhere on twitter that the current sequence of consecutive up days in the markets has been a record not seen in the last 40 years. I don't know if that is true? what I do see is that every single attempt by the bears to bring the markets down, has been meet with a strong resistance from the bulls. Today was a good example. As NDX gapped down quite a bit as the markets opened but it ended the day in green territory. It was quite evident that all the sell orders are being absorbed instantaneously by buy orders from the hungry bulls. It almost felt like someone was preventing the market from going down tod. Who knows may be the fed, a another big institution from a foreign country, a group of large banks, etc. are defending certain levels of the indices for their vested interests. The $ (USD) has been in a similar uptrend since Aug last year and could be a partial catalyst for the current move in the equities.

Despite the appearance of a fierce upward move in the indices, it has been a gradual grind, slowly drifting upwards in small increments. On several days of the current vertical up move, its hard to tell, if the market really closed up or down? One of my observation has been the persistence of low volatility over this period.

From a technician point of view the market is way over extended above its (most commonly used) 20, 50, 200 DMA's and is ready for a pullback any time.

Despite the predictions (of financial guru's) of a slower economy and a down trend, in the equity markets, commensurate with the change in the US Govt, the Fed signaling hikes in interest rates this year, the market is unaffected. It seems to be welcoming the announcements of de-regulations and the enactment of restrictions on foreign trade. One of the reasons for this bull run could be the better than expected earnings this quarter being reported by the US companies, as well as, the prevailing economic conditions such as record low unemployment and interest rates.

Today, I read somewhere on twitter that the current sequence of consecutive up days in the markets has been a record not seen in the last 40 years. I don't know if that is true? what I do see is that every single attempt by the bears to bring the markets down, has been meet with a strong resistance from the bulls. Today was a good example. As NDX gapped down quite a bit as the markets opened but it ended the day in green territory. It was quite evident that all the sell orders are being absorbed instantaneously by buy orders from the hungry bulls. It almost felt like someone was preventing the market from going down tod. Who knows may be the fed, a another big institution from a foreign country, a group of large banks, etc. are defending certain levels of the indices for their vested interests. The $ (USD) has been in a similar uptrend since Aug last year and could be a partial catalyst for the current move in the equities.

Despite the appearance of a fierce upward move in the indices, it has been a gradual grind, slowly drifting upwards in small increments. On several days of the current vertical up move, its hard to tell, if the market really closed up or down? One of my observation has been the persistence of low volatility over this period.

From a technician point of view the market is way over extended above its (most commonly used) 20, 50, 200 DMA's and is ready for a pullback any time.

Tuesday, February 21, 2017

Relationship between $ (USD) and the US stock market

If we compare the US Dollar Index (USDX), an index that tracks the value of the U.S. dollar against six other major currencies, and the value of the Dow Jones Industrial Average (DJIA), Nasdaq and S&P 500 over a 20-year period, the correlation coefficient calculated for the USDX versus the DJIA, Nasdaq and S&P 500, is 0.35, 0.39 and 0.38, respectively. Note that all of the coefficients are positive, which means that as the value of the U.S. dollar increases, so do the stock indexes, but only by a certain amount. Notice also that each coefficient is below 0.4, which means that only about 35% to 40% of the stock indexes' movements are associated with the movement of the U.S. dollar.

Read more: What is the correlation between American stock prices and the value of the U.S. dollar? | Investopedia http://www.investopedia.com/ask/answers/06/usdollarcorrelation.asp#ixzz4ZORdAV2M

Follow us: Investopedia on Facebook

Read more: What is the correlation between American stock prices and the value of the U.S. dollar? | Investopedia http://www.investopedia.com/ask/answers/06/usdollarcorrelation.asp#ixzz4ZORdAV2M

Follow us: Investopedia on Facebook

Saturday, February 4, 2017

Thursday, February 2, 2017

Amazon's Q4 2016 earnings

Amazon.Com (AMZN) reported 4th Quarter December 2016 earnings of $1.54 per share on revenue of $43.7 billion. The consensus earnings estimate was $1.40 per share on revenue of $44.8 billion. The Earnings Whisper number was $1.44 per share. Revenue grew 22.4% on a year-over-year basis.

The company said it expects first quarter revenue of $33.25 billion to $35.75 billion. The current consensus revenue estimate is $35.83 billion for the quarter ending March 31, 2017.

The company said it expects first quarter revenue of $33.25 billion to $35.75 billion. The current consensus revenue estimate is $35.83 billion for the quarter ending March 31, 2017.

Friday, January 20, 2017

Tuesday, January 17, 2017

Sunday, January 8, 2017

NDX current contition

After making new highs of 4994 the market declined near the end of last month, found support at 4855 on 12/30 has gone up for 4 consecutive days, taking NDX to new all time highs of 5018 last week. In the process the index has broken out of the range that it has traded in during the month of Dec. last year being the most bullish time of the year we can see the index making new highs..

01/06/17

01/03/17

01/06/17

01/03/17

Subscribe to:

Posts (Atom)